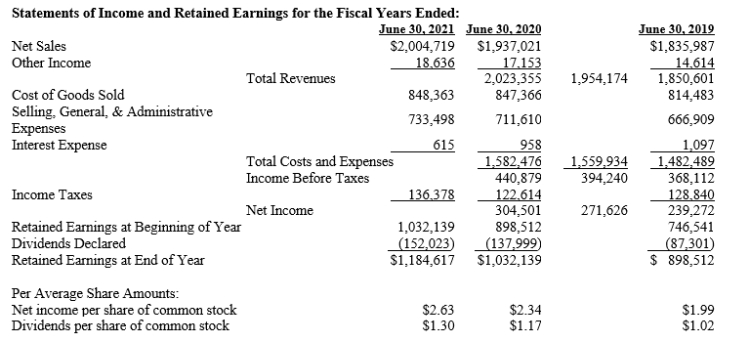

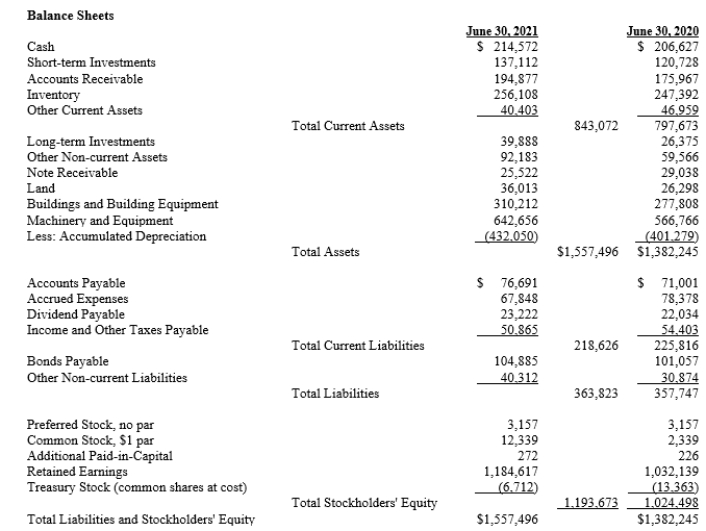

Recovery Solutions, Inc.Comparative financial statements are provided below:

-Refer to Recovery Solutions, Inc. Evaluate the company's profitability ratios for 2021 and 2020, including the gross profit percentage, operating margin percentage, net profit margin percentage, return on assets, and return on equity. Assume that total assets and total stockholders' equity at June 30, 2019 were $1,250,000 and 969,000, respectively. Also assume that the tax rate is 30% for all periods presented.

Definitions:

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against a fixed asset since it was put into use, used to reduce the book value of assets on the balance sheet.

Fair Value

The estimated market price of an asset or liability, based on current market conditions and comparable transactions.

Increasing-Balance

A method of calculating depreciation that applies a constant rate to the asset's net book value each year, resulting in increased depreciation charges over time.

Q37: A consulting firm provided services last month

Q45: Common size financial statements exclude the dollar

Q56: Form that companies must file with the

Q83: Which of the following results is generally

Q119: Which of the following is the correct

Q131: Percentage of earnings paid out as dividends.<br>A)Debt-to-equity

Q135: A particular balance sheet includes the following

Q145: Since stock dividends are paid with shares

Q154: Refer to LaFarge North America. What is

Q224: Which of the following statements is true