Mary Kay Cosmetics

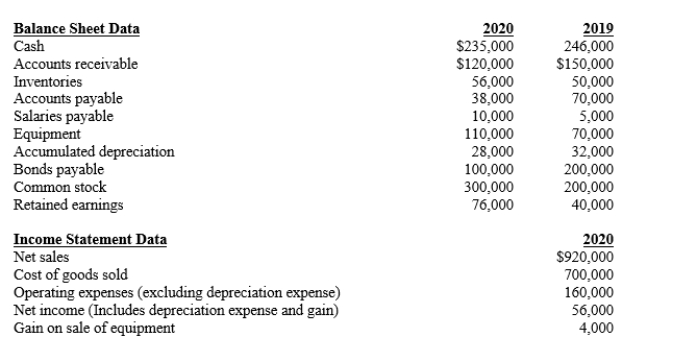

Selected data and additional information from the company's records are presented below:  Additional information:

Additional information:

-Refer to Mary Kay Cosmetics. What amount was declared and paid for dividends during 2020?

Definitions:

Average Tax Rate

Average Tax Rate is the proportion of the total income paid as taxes, calculated by dividing the total taxes by the total taxable income.

Total Taxes

The combined amount of all the taxes imposed by a government on an individual or business, including income tax, property tax, sales tax, etc.

Average Tax Rate

The proportion of total income that is paid in taxes, calculated by dividing the total tax paid by the total income.

Total Income

The sum of all earnings obtained by an individual, household, or firm, including wages, salaries, profits, rents, and other forms of revenue.

Q13: Refers to a situation where an error

Q62: A debt security exists when another entity

Q69: The distribution of returns, measured over long

Q83: An intangible asset arising from attributes that

Q88: The collection of accounts receivable results in

Q97: Appropriations of retained earnings must be reported<br>A)in

Q111: The following stockholders' equity appeared on a

Q162: A set of reports that communicate a

Q177: A measure of the proportion of dividends

Q184: A decrease in retained earnings represents dividends