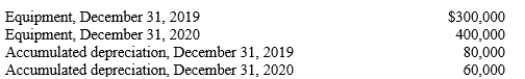

Selected information from the company's financial records is presented below:  During 2020, the company sold equipment with a cost of $50,000 and accumulated depreciation of $30,000. A gain of $10,000 was recognized on the sale of the equipment. This was the only equipment sale during the year.

During 2020, the company sold equipment with a cost of $50,000 and accumulated depreciation of $30,000. A gain of $10,000 was recognized on the sale of the equipment. This was the only equipment sale during the year.

-Refer to Metalcrafts, Inc. Assume that all purchases of equipment were paid with cash. How much cash was paid to purchase equipment during 2020?

Definitions:

Physical Inventory

The process of counting the actual inventory on hand at the end of an accounting period, usually for verification purposes.

Inventory System

A system for tracking inventory levels, orders, sales, and deliveries, which can be manual or technologically driven, helping businesses manage their stock efficiently.

Cost Of Goods Sold

The total cost associated with making or buying products that a company has sold during a specific period.

Gross Profit

The financial gain achieved after deducting the cost of goods sold from total sales revenue, not including other operating expenses, interest, or taxes.

Q12: The historical returns data for the past

Q23: When stockholders receive a distribution of additional

Q54: Which one of the following items is

Q75: When using the indirect method to determine

Q94: Which one of the following equations represents

Q95: Repaid a long-term bonds payable.<br>A)Inflow from operating

Q105: Use the selected financial information provided below

Q107: Cash flows from operating activities correspond to

Q173: When an investor is evaluating whether to

Q191: Accumulated other comprehensive income is NOT considered