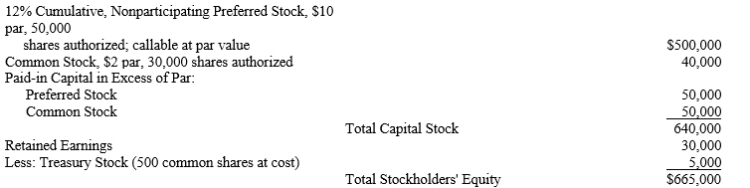

A corporation reported the following information at December 31:

A)How many shares of preferred stock are issued?

B)How many shares of common stock are issued?

C)How many shares of preferred stock are outstanding?

D)How many shares of common stock are outstanding?

E)How many of the preferred shares will receive dividends if they are paid?

F)How many of the common shares will receive dividends if they are paid?

G)What is the stated dividend per share on the preferred stock?

H)What is the total amount of dividends to be paid to preferred stockholders this year?

I)If all of the preferred stock was issued at the same price, what was the issue price per share?

J)If all of the common stock were issued at the same price, what was the issue price per share?

Definitions:

Invested at

Typically implies allocating resources, such as time or money, into a venture, asset, or project with the expectation of receiving future returns.

Internal Rate of Return

A financial metric used to evaluate the profitability of potential investments, calculated as the interest rate that makes the net present value of all cash flows equal to zero.

Net Present Value

The difference between the present value of cash inflows and the present value of cash outflows over a period of time, used to assess the profitability of an investment or project.

Discount Rate

The interest rate used in discounted cash flow analysis to determine the present value of future cash flows.

Q3: Operating activities involve the acquiring and selling

Q15: Refer to Maritime Marine Services. Assuming that

Q29: Given the following data for Project M:

Q38: If the depreciable investment is $1,000,000 and

Q50: Two machines, A and B, which perform

Q57: Beginning equipment minus equipment sold and minus

Q58: The risk-free rate is 4%, the market

Q78: Suppose you borrow at the risk-free rate

Q149: Cumulative and participating dividend features are typically

Q194: Some companies use a work sheet approach