Ladder Distributors

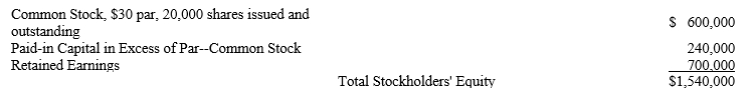

The stockholders' equity section of the December 31, 2019, balance sheet is provided below:

Assume that all of the 20,000 shares of stock that was issued as of December 31, 2019, was issued for $42 per share. On March 1, 2020, the company reacquired 4,000 shares of its common stock for $50 per share.

Assume that all of the 20,000 shares of stock that was issued as of December 31, 2019, was issued for $42 per share. On March 1, 2020, the company reacquired 4,000 shares of its common stock for $50 per share.

-Refer to Ladder Distributors. Suppose the company reissued 1,000 shares of its treasury stock on June 1, 2020, for $39 each. Which of the following is true regarding the entry required to record this transaction?

a.A debit to treasury stock is required for $50,000.

b.A credit to treasury stock is required for $39,000.

c.A debit to retained earnings is required for $11,000.

d.A debit to paid-in capital from treasury stock transactions is required for $3,000.

Definitions:

Stockholders' Equity

The residual interest in the assets of a corporation that remains after deducting its liabilities, representing the ownership interest of the stockholders.

Income Statement

A financial statement that shows a company’s revenue and expenses over a specific period, determining its profit or loss.

Expense Accounts

Accounts used in accounting to track the consumption of economic resources or the incurrence of liabilities in the operation of a company.

Credits

Entries made on the right-hand side of an account, representing gains or increases in liabilities, income, or equity.

Q5: Briefly explain the concept of value additivity.

Q6: Form that represents the company's annual report

Q26: The graphical representation of CAPM (Capital Asset

Q65: Sold office building for cash.<br>A)Inflow from operating

Q95: What do profitability ratios measure?

Q111: Which of the following statements is most

Q161: Refer to Medstar Ambulance Service. The following

Q171: Preferred stockholders typically do not have the

Q182: If the stated cash dividend on cumulative

Q193: Mercury Corporation reported the following information on