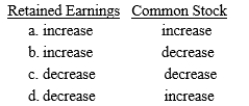

A corporation reported net income of $60,000, declared and paid cash dividends of $80,000, and issued 3,000 shares of $2 par common stock at $15 per share during the year. What total effects would these transactions have on the following stockholders' equity accounts?

Definitions:

Regulation A

Regulation A is an exemption from the registration requirements mandated by the SEC, allowing smaller companies to raise capital through the sale of equity or debt securities without having to adhere to traditional public offering rules.

Term Loans

Direct business loans of, typically, one to five years.

Private Debt

Loans and debt financing instruments that are not publicly traded, typically provided by private investors or non-bank financial entities.

Q7: When is a liability for dividends created?<br>A)at

Q15: The type of the risk that can

Q21: Cumulative preferred dividends that have not been

Q57: What has been the average annual nominal

Q112: Using debt to help the company earn

Q163: Under the indirect method, a gain from

Q209: Most companies<br>A)agree that a current ratio of

Q209: A measure of net income measured by

Q210: Refer to Lanier Tech. What is the

Q233: Represents the owners' claims against the assets