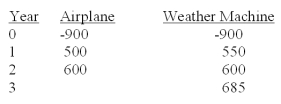

RainMan Inc. is in the business of producing rain upon request. They must decide between two investment projects; a new airplane for seeding rain clouds or a new weather control machine built by Dr. Nutzbaum. The discount rate for the new airplane is 9%, while the discount rate for the weather machine is 39% (it happens to be higher risk) . Which investment should the company select and why?

Definitions:

Compounded Semi-annually

The process of adding interest to the principal sum of a deposit or loan every six months, so that each subsequent interest calculation is based on the original principal plus all accumulated interest.

Ordinary Annuity

A series of equal payments made at equal intervals of time, with the first payment occurring at the end of the period.

Present Value

The current value of a future sum of money or stream of cash flows given a specified rate of return.

Compounded Quarterly

The method of calculating interest where the interest is added to the principal sum four times a year.

Q13: What has been the standard deviation of

Q27: Discuss the general principle in the valuation

Q38: Dividends in arrears are required to be

Q39: If the depreciation amount is 600,000 and

Q39: Which bond is more sensitive to an

Q50: Which of the following stocks is (are)

Q57: What has been the average annual nominal

Q67: The New York Stock Exchange is the

Q103: _ securities, such as bonds, exist when

Q128: Date on which the Board of Directors