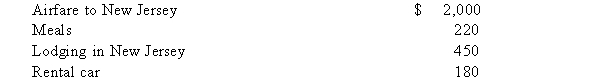

(described below) . What amount can Shelley deduct as an employee business expense (before considering any miscellaneous itemized deduction limitations) ?

Definitions:

Organizing

The process of arranging or structuring elements in a systematic way to achieve efficiency and order.

Résumé

A document summarizing an individual's background, education, and job qualifications, crucial for job applications.

Keywords

Specific words or phrases used in digital content to optimize search engine rankings, or to highlight main concepts in texts, making information retrieval more efficient.

Introductory Statement

An opening remark or paragraph that sets the context, purpose, or scope of a document, presentation, or conversation.

Q2: What are some of the costs associated

Q7: The managing underwriter is also called the:<br>A)

Q15: Realized income is included in gross income

Q27: State laws that regulate sales of securities

Q30: The manufacture of herbal health tonic is

Q33: Clyde operates a sole proprietorship using the

Q48: Why would a taxpayer file a tax

Q59: After the completion of project analysis, the

Q64: The following are advantages of shelf registration

Q109: The wage base for which of the