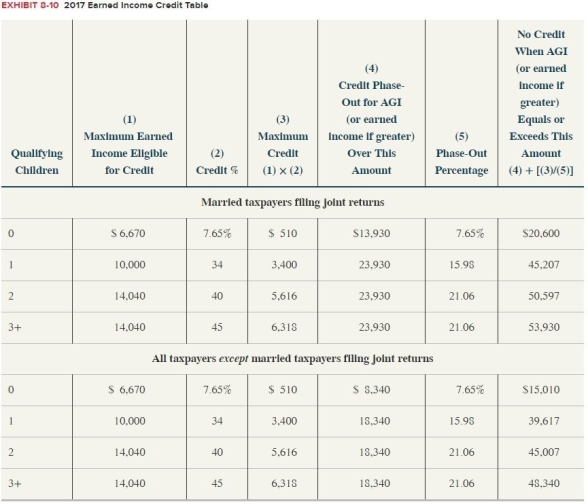

Sam is 30 years old. In 2017, he reported an AGI of $12,000, all from his job as a server at the local café. He is single and has no dependents. What amount of earned income credit may he claim in2017? Use Exhibit 8-10.

Definitions:

Doctor Treats

involves the actions and procedures performed by physicians to care for and manage the health conditions of their patients.

Third Party

An entity or individual that is not directly involved in a legal agreement or contract but may be affected by its outcomes or has an indirect interest in it.

Camera

A device used to capture images or videos, consisting of a lens and a body that records visual information on a medium or sensor.

Trespass to Chattels

A legal term referring to the intentional interference with someone else's personal property without permission.

Q25: Define the term "Economic Value Added (EVA)."

Q30: Deductible medical expenses include payments to medical

Q36: Unrecaptured §1250 gain is taxed at the

Q43: Which of the following statements concerning tax

Q68: Which of the following is likely to

Q72: Business credits are generally refundable credits.

Q79: Relative to for AGI deductions, from AGI

Q81: What is the underpayment penalty rate that

Q87: When considering cash outflows, higher present values

Q95: Which of the following is a true