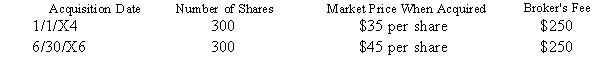

On December 1, 20X7, George Jimenez needed a little extra cash for the upcoming holiday season, and sold250 shares of Microsoft stock for $50 per share less a broker's fee of $200 for the entire sale transaction. Prior to the sale, George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase):  If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

Definitions:

Motorists

Individuals who operate cars or other motor vehicles.

Speed Limit

The maximum legal speed at which vehicles may travel on a particular road or in a specific area.

Gas Mileage

A measure of how many miles a vehicle can travel on a gallon of gasoline, often used as an indicator of fuel efficiency.

Traffic Accidents

Unforeseen incidents that occur on the road involving vehicles, pedestrians, or cyclists, often resulting in injury or damage.

Q5: Kaylee is a self-employed investment counselor who

Q7: Both the width (or range) of the

Q11: Alain Mire files a single tax return

Q20: Why is sensitivity analysis less realistic than

Q21: When applying credits against a taxpayer's gross

Q34: Which of the following is needed to

Q45: The expected rise in the price of

Q72: Business credits are generally refundable credits.

Q79: Assume that Lavonia's marginal tax rate is

Q95: A taxpayer earning income in "cash" and