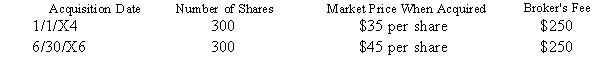

On December 1, 20X7, George Jimenez needed a little extra cash for the upcoming holiday season, and sold250 shares of Microsoft stock for $50 per share less a broker's fee of $200 for the entire sale transaction. Prior to the sale, George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase):  If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

Definitions:

Opsonization

The process where pathogens are marked for destruction by immune cells through the binding of antibodies or complement proteins.

Phagocytosis

The process by which a cell engulfs particles such as bacteria or cellular debris to digest them.

Antigens

Substances (often proteins) on the surface of cells, viruses, fungi, or bacteria that the immune system recognizes and targets.

Lymphatic Capillaries

Small, thin-walled vessels that are the starting point of the lymphatic system, responsible for the absorption of interstitial fluid and its return to the bloodstream.

Q7: Andres and Lakeisha are married and file

Q12: How are individual taxpayers' investment expenses and

Q39: You are given the following data for

Q47: Casey currently commutes 35 miles to work

Q82: A personal automobile is a capital asset.

Q84: The constructive receipt doctrine:<br>A) applies equally to

Q96: Which of the following is an example

Q102: Which of the following is a description

Q108: Interest earned on a Federal Treasury bond

Q118: butter), and punitive damages ($44,000). What amount