Multiple Choice

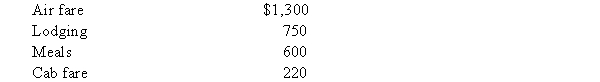

Fred's employer dispatched him on a business trip from the Dallas headquarters to New York78t) his year. During the trip Fred incurred the following unreimbursed expenses:  What is the amount of Fred's deduction before the application of any AGI limitations?

What is the amount of Fred's deduction before the application of any AGI limitations?

Definitions:

Related Questions

Q4: KMW Inc. sells a finance textbook for

Q10: For married couples, the Social Security wage

Q28: Long-term capital gains for individual taxpayers can

Q36: Unrecaptured §1250 gain is taxed at the

Q75: A below-market loan (e.g., from an employer

Q77: A gratuitous transfer of cash made directly

Q90: Community property laws dictate that income earned

Q100: Which of the following transfers is a

Q122: Which of the following is not a

Q153: Which of the following is not true