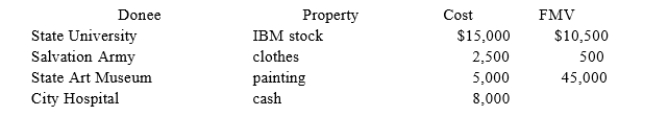

This year Darcy made the following charitable contributions:  Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is$80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum consistent with museum's charitablepurpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is$80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum consistent with museum's charitablepurpose.

Definitions:

Path-goal Theory

Path-goal Theory is a leadership model that suggests a leader's behavior is contingent to the satisfaction, motivation, and performance of their subordinates, aiming to clear the path to their goals.

Minimal Effort

The least amount of physical or mental energy expended to achieve an objective.

Effective Time Management

The practice of organizing and planning how to allocate your time between specific activities wisely and efficiently.

Interdependent Roles

Positions or functions within a system that rely on each other to achieve objectives or outcomes.

Q10: The value of a tax deduction is

Q15: Joshua and David purchased real property for

Q22: Mike operates a fishing outfitter as an

Q26: Lydia and John Wickham filed jointly in

Q57: This year Don and his son purchased

Q59: Joe is a self-employed electrician who operates

Q84: Juan works as a landscaper for local

Q89: A taxpayer who is claimed as a

Q129: Rhianna and Jay are married filing jointly

Q137: John and Sally pay Janet (Sally's older