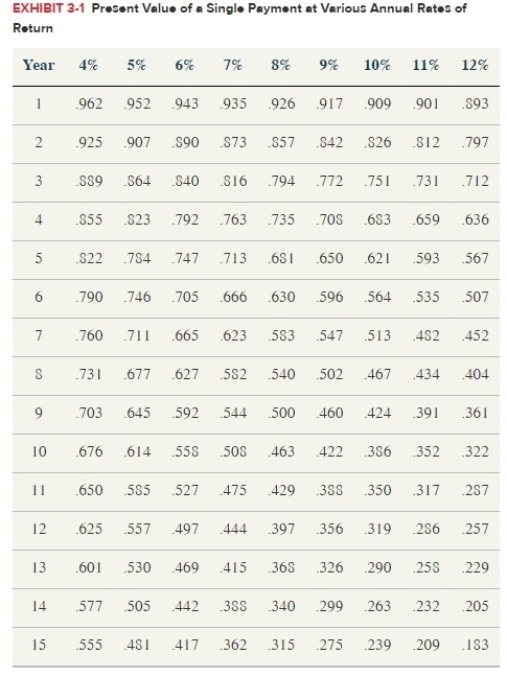

Based only on the information provided for each scenario, determine whether Kristi or Cindy will benefit more from using the timing strategy and why there will be a benefit to that person. Use Exhibit 3.1.  a. Kristi has a 40% tax rate and can defer $20,000 of income. Cindy has a 30% tax rate and can defer $30,000 of income.b. Kristy has a 30% tax rate, a 10% after-tax rate of return, and can defer $25,000 of income for three years. Cindy has a 40% tax rate, an 8% after-tax rate of return, and can defer $20,000 of income for four years.

a. Kristi has a 40% tax rate and can defer $20,000 of income. Cindy has a 30% tax rate and can defer $30,000 of income.b. Kristy has a 30% tax rate, a 10% after-tax rate of return, and can defer $25,000 of income for three years. Cindy has a 40% tax rate, an 8% after-tax rate of return, and can defer $20,000 of income for four years.

Definitions:

Family Disadvantage

Relates to the negative impacts on an individual's development that arise from factors such as poverty, lack of education, and family strife.

Risky Behavior

Actions that expose individuals to danger or harm, often with a disregard for the negative consequences.

Gray Matter

The darker tissue of the brain and spinal cord, consisting mainly of nerve cell bodies and branching dendrites.

Frontal Lobes

Regions of the brain located at the front of each cerebral hemisphere, responsible for decision making, problem solving, control of purposeful behaviors, consciousness, and emotions.

Q7: When a carpenter provides $100 of services

Q7: CB Corporation was formed as a calendar-year

Q14: Which of the following S corporations would

Q19: All of the following are tests for

Q33: A taxpayer paying his 10-year-old daughter $50,000

Q62: Wendell is an executive with CFO Tires.

Q81: A portion of each payment received from

Q86: One limitation of the timing strategy is

Q107: Assume that Clampett, Inc. has $200,000 of

Q111: At his death Stanley owned real estate