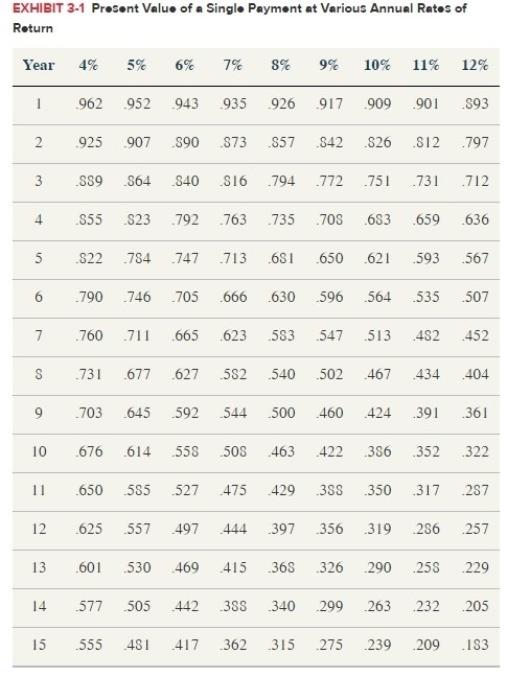

Sal, a calendar year taxpayer, uses the cash-basis method of accounting for his sole proprietorship.In late December he performed $40,000 of consulting services for a client. Sal typically requires his clients to pay his bills immediately upon receipt. Assume that Sal's marginal tax rate is 30% this year and 35% next year and that he can earn an after-tax rate of return of 12% on his investments. Should Sal send his client the bill in December or January? Use Exhibit 3.1.

Definitions:

Blockchain

A decentralized digital ledger technology where transactions are recorded in a secure, transparent, and immutable manner across multiple computers.

Facial Authentication

A security process that uses the unique characteristics of a person's face to verify their identity.

Wearable Technology

Electronic devices designed to be worn on the body, such as smartwatches and fitness trackers, which often offer connectivity and personal data monitoring functionalities.

Electronic Commerce

The buying and selling of goods and services, or the transmitting of funds or data, over an electronic network, primarily the internet.

Q5: Assume that Jose is indifferent between investing

Q11: Nontax factors do not play an important

Q13: A U.S. corporation reports its foreign tax

Q29: David, an attorney and cash basis taxpayer,

Q37: Including adjusted taxable gifts in the taxable

Q47: Appleton Corporation, a U.S. corporation, reported total

Q55: Angel and Abigail are married and live

Q85: Troy is not a very astute investor.

Q109: A bypass provision in a will requires

Q111: From AGI deductions are generally more valuable