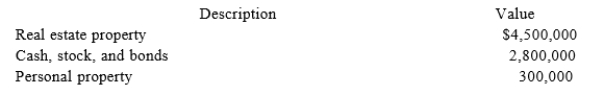

Sophia is single and owns the following property:  Sophia owns the real property in joint tenancy with Daniel. They purchased the property several years ago for$1 million. Sophia was only able to provide $200,000 of the purchase price. If Sophia dies, what is the amount of her gross estate?

Sophia owns the real property in joint tenancy with Daniel. They purchased the property several years ago for$1 million. Sophia was only able to provide $200,000 of the purchase price. If Sophia dies, what is the amount of her gross estate?

Definitions:

Homosexuality

A sexual orientation characterized by attraction, either romantically or sexually, to individuals of the same gender.

Asexuality

A sexual orientation characterized by a lack of sexual attraction towards others.

Bisexuality

Sexual orientation characterized by attraction to people of both one's own gender and other genders, not necessarily to the same degree or at the same time.

Heterosexuality

The sexual attraction or orientation towards people of the opposite sex.

Q3: For the holidays, Samuel gave a necklace

Q5: The standard deduction amount varies by filing

Q7: If a taxpayer does not provide more

Q11: Catherine is a 30% partner in the

Q20: Danny argues that tax accountants suffer from

Q34: Lebron received $50,000 of compensation from his

Q62: Tom is talking to his friend Bob,

Q111: Aubrey and Justin divorced on June 30

Q113: Sally received $50,000 of compensation from her

Q120: The gross estate will not include the