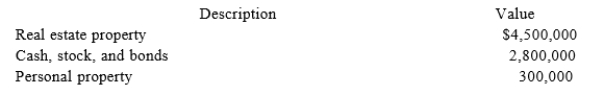

Sophia is single and owns the following property:  Sophia owns the real property in joint tenancy with Daniel. They purchased the property several years ago for$1 million. Sophia was only able to provide $200,000 of the purchase price. If Sophia dies, what is the amount of her gross estate?

Sophia owns the real property in joint tenancy with Daniel. They purchased the property several years ago for$1 million. Sophia was only able to provide $200,000 of the purchase price. If Sophia dies, what is the amount of her gross estate?

Definitions:

Assessment Process

A systematic procedure for collecting, analyzing, and interpreting information to evaluate individuals, groups, or programs.

DSM-I

The first edition of the Diagnostic and Statistical Manual of Mental Disorders, published by the American Psychiatric Association.

20th Century

A historical era spanning from the year 1901 to 2000, noted for significant developments in technology, politics, and culture.

Single-axis Approach

A diagnostic method focusing on one dimension or aspect of an issue or disease, often criticized for oversimplifying complex problems.

Q12: The gift-splitting election only applies to gifts

Q13: Which of the following transactions would not

Q31: If an S corporation shareholder sells her

Q35: Teresa was married on November 1 of

Q49: Unemployment benefits are excluded from gross income.

Q60: At the beginning of the year, Clampett,

Q61: Which is not a basic tax planning

Q71: This year Barney purchased 500 shares of

Q97: An exemption equivalent is the amount of

Q101: To make an S election effective as