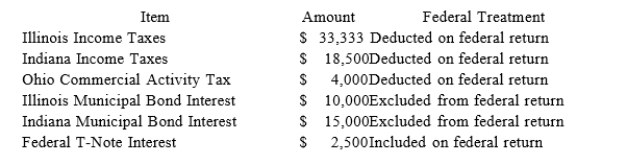

PWD Incorporated is an Illinois corporation. It properly included, deducted, or excluded the80) following items on its federal tax return in the current year:  PWD's Federal Taxable Income was $100,000. Calculate PWD's Illinois state tax base.

PWD's Federal Taxable Income was $100,000. Calculate PWD's Illinois state tax base.

Definitions:

Emerging Adulthood

A developmental phase between adolescence and full-fledged adulthood, characterized by exploration, instability, and self-focus.

Stability

The quality of being steady, consistent, and less likely to change or fail.

Identity Confirmation

The validation and recognition of one's self-concept by others, contributing to a person's sense of identity.

Senescence

The process of biological aging, characterized by a gradual decrease in physiological function and increased susceptibility to diseases.

Q8: SoTired, Inc., a C corporation with a

Q8: The Senate Ways and Means Committee is

Q11: Businesses subject to income tax in more

Q27: Assume that Javier is indifferent between investing

Q27: To be eligible for the "closer connection"

Q35: Which of the following statements regarding exemptions

Q45: S corporation shareholders are not allowed to

Q58: S corporations are required to recognize both

Q58: Gouda, S.A., a Belgium corporation, received the

Q74: Tracey is unmarried and owns $7 million