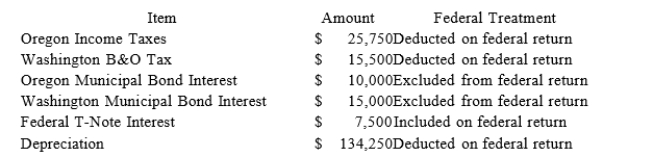

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  Moss' Oregon depreciation was $145,500. Moss' Federal Taxable Income was $549,743. Calculate Moss' Oregon state tax base.

Moss' Oregon depreciation was $145,500. Moss' Federal Taxable Income was $549,743. Calculate Moss' Oregon state tax base.

Definitions:

Interdependent

Being mutually dependent, where the actions of one party significantly affect the other.

Self-Monitoring

The awareness and regulation of one's behavior in accordance with the social situations and norms.

Social Cues

Nonverbal gestures, expressions, or behaviors that communicate information or influence interactions in social settings.

Self-Efficacy

An individual's belief in their own capability to perform actions and achieve goals, influencing their motivation and behavior.

Q1: Tyrone claimed a large amount of charitable

Q3: Tennis Pro is headquartered in Virginia. Assume

Q38: Assume that Keisha's marginal tax rate is

Q52: Which of the following does not limit

Q58: The income shifting strategy requires taxpayers with

Q78: Lefty provides demolition services in several southern

Q88: Implicit taxes may reduce the benefits of

Q99: All 50 states impose a sales and

Q116: Adjusted taxable gifts are included when calculating

Q131: MWC is a C corporation that uses