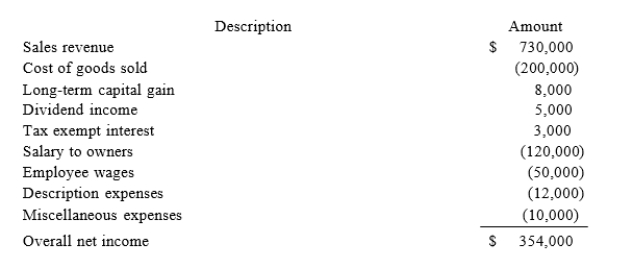

XYZ Corporation (an S corporation) is owned by Jane and Rebecca who are each 50% shareholders. At the beginning of the year, Jane's basis in her XYZ stock was $40,000. XYZ reported the following tax information for 2017.  Required:a. What amount of ordinary business income is allocated to Jane?b. What is the amount and character of separately stated items allocated to Jane?c. What is Jane's basis in her XYZ corp. stock at the end of the year?

Required:a. What amount of ordinary business income is allocated to Jane?b. What is the amount and character of separately stated items allocated to Jane?c. What is Jane's basis in her XYZ corp. stock at the end of the year?

Definitions:

Ethnocentrism

The act of judging another culture solely by the values and standards of one's own culture.

Ethics

A branch of philosophy that deals with systematizing, defending, and recommending concepts of right and wrong behavior.

Culture

The shared beliefs, customs, practices, and social behavior of a particular nation or people.

Individualistic

relates to a social theory favoring freedom of action for individuals over collective or state control.

Q1: Tyrone claimed a large amount of charitable

Q22: Wonder Corporation declared a common stock dividend

Q42: Camille transfers property with a tax basis

Q59: Zhao incorporated her sole proprietorship by transferring

Q63: A liquidated corporation will always recognize loss

Q63: Roxy operates a dress shop in Arlington,

Q68: Boca Corporation, a U.S. corporation, received a

Q72: Which of the following persons should not

Q89: Continuity of interest as it relates to

Q95: If Paula requests an extension to file