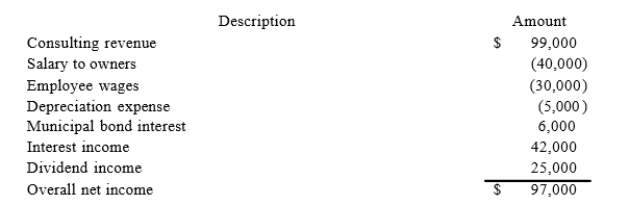

RGD Corporation was a C corporation from its inception in 2012 through 2016. However, it elected Scorporation status effective January 1, 2017. RGD had $50,000 of earnings and profits at the end of 2016. RGDreported the following information for its 2017 tax year.  What amount of excess net passive income tax is RGD liable for in 2017? (Round your answer for excess net passive income to the nearest thousand).

What amount of excess net passive income tax is RGD liable for in 2017? (Round your answer for excess net passive income to the nearest thousand).

Definitions:

Canada's Divorce Act of 1985

Legislation that reformed divorce laws in Canada, establishing a no-fault divorce process based on the breakdown of the marriage.

Unpaid Household Labour

Unpaid household labour encompasses all non-remunerative tasks performed within a household, such as cleaning, cooking, and caring for family members, significant for economic analyses and gender studies.

Canadian Divorce Law

A set of legal statutes and procedures governing the dissolution of marriage in Canada, addressing issues such as property division, spousal support, and child custody.

Same-sex Marriage

The legally or socially recognized marriage between two individuals of the same sex.

Q4: Which statement best describes the U.S. framework

Q18: St. Clair Company reports positive current E&P

Q36: Luther was very excited to hear about

Q47: Any losses that exceed the tax basis

Q50: Federico is a 30% partner in the

Q57: Riley is a 50% partner in the

Q61: Which of the following amounts is not

Q69: Jonathan transferred $90,000 of cash to a

Q100: Randolph is a 30% partner in the

Q107: Assume that Clampett, Inc. has $200,000 of