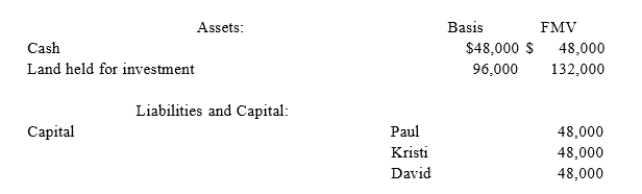

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000. Just prio7r4) to the sale, Paul's outside and inside bases in KDP are $48,000. KDP's balance sheet includes the following:  If KDP has a §754 election in place, what is Kathy's special basis adjustment?

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

Definitions:

Horizontal Loading

An approach to job design that involves broadening the range of tasks performed by an employee to add variety and encourage skill development.

Form Natural Units

Organize or group elements based on inherent or intrinsic characteristics that naturally belong together.

Open Feedback Channels

Systems or processes established to facilitate the free exchange of feedback among individuals or groups within an organization.

Job Enrichment

A method of motivating employees by giving them more responsibility and variety in their jobs.

Q16: Why are guaranteed payments deducted in calculating

Q28: Heidi and Teresa are equal partners in

Q32: Which of the following tax rules applies

Q37: Rental income is allocated to the state

Q55: A partner can generally apply passive activity

Q78: Which of the following is not a

Q78: Which statement best describes the U.S. framework

Q92: Inez transfers property with a tax basis

Q93: Kristen and Harrison are equal partners in

Q114: Suppose at the beginning of 2017, Jamaal's