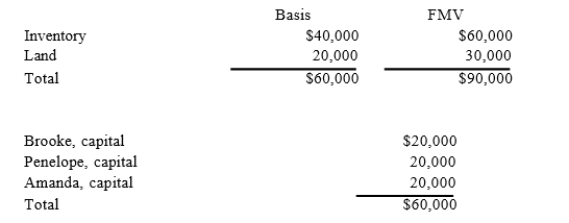

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of$20,000. BPA reports the following balance sheet:  a. Identify the hot assets if Brooke decides to sell her interest in BPA. b. Are these assets "hot" for purposes of distributions?c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issuesshould be considered?

a. Identify the hot assets if Brooke decides to sell her interest in BPA. b. Are these assets "hot" for purposes of distributions?c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issuesshould be considered?

Definitions:

Film Noir

A cinematic term used to describe stylish Hollywood crime dramas, particularly those that emphasize cynical attitudes and sexual motivations.

Antagonist

The major character in a film whose values or behavior is in conflict with that of the protagonist.

Liquidation

The process of bringing a business to an end and distributing its assets to claimants, often in the context of bankruptcy.

Antitrust Lawsuits

Legal actions initiated to challenge practices or agreements that are deemed to restrict free trade and competition in the marketplace.

Q1: State tax law is comprised solely of

Q3: In a tax-deferred transaction, the calculation of

Q11: Gwendolyn was physically present in the United

Q26: A partner will recognize a loss from

Q32: Sales personnel investigating a potential customer's credit

Q51: Austin Corporation, a U.S. corporation, received the

Q65: Katarina transferred her 10 percent interest to

Q79: Several states are now moving from a

Q84: Janet Mothra, a U.S. citizen, is employed

Q87: Lansing Company is owned equally by Jennifer,