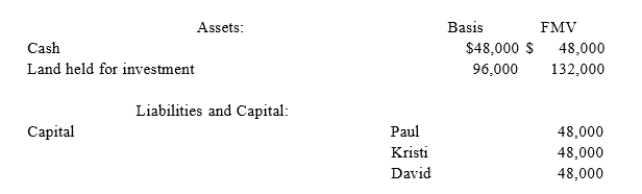

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000. Just prio7r4) to the sale, Paul's outside and inside bases in KDP are $48,000. KDP's balance sheet includes the following:  If KDP has a §754 election in place, what is Kathy's special basis adjustment?

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

Definitions:

Advantages

The favorable aspects or benefits that something provides, often compared to other options or situations.

Disadvantages

Negative aspects or conditions that reduce the effectiveness or desirability of something.

Agent's Liability

refers to the legal responsibility an agent holds when acting on behalf of a principal, including obligations and potential damages or losses that occur during the act.

Principal

In financial contexts, the amount of money originally invested or loaned, excluding any interest or profit.

Q4: Which statement best describes the U.S. framework

Q10: Pine Creek Company is owned equally by

Q47: Appleton Corporation, a U.S. corporation, reported total

Q56: At his death Titus had a gross

Q59: Zhao incorporated her sole proprietorship by transferring

Q62: Tom is talking to his friend Bob,

Q66: Guaranteed payments are included in the calculation

Q75: Keegan incorporated his sole proprietorship by transferring

Q80: Jimmy Johnson, a U.S. citizen, is employed

Q100: A non U.S. citizen with a green