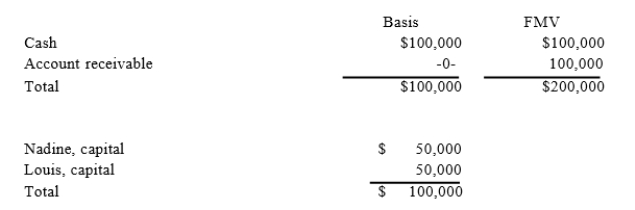

Nadine Fimple is a one-half partner in the NL Partnership with equal inside and outside bases. On January 1, NL distributes accounts receivable with a fair value of $100,000 to Nadine as an operating distribution. NL's balance sheet as of January 1 is as follows:  What is the amount and character of Nadine's recognized gain or loss on the distribution?

What is the amount and character of Nadine's recognized gain or loss on the distribution?

Definitions:

Acquisition Analysis

The process of evaluating the financial, operational, and strategic aspects of a target company during a merger or acquisition.

Post-acquisition Equity

The value of the equity interest in a subsidiary held by a parent company after adjusting for the cost of acquisition and other factors.

Consolidation Worksheet Entries

Journal entries used in the preparation of consolidated financial statements which adjust, eliminate, and combine account balances from separate financial statements of parent and subsidiary entities.

Consolidated Financial Statements

Financial statements that aggregate the financial position, results of operations, and cash flows of a parent company and its subsidiaries.

Q6: Handsome Rob provides transportation services in several

Q12: During 2017, CDE Corporation (an S corporation

Q17: For partnership tax years ending after December

Q36: Viking Corporation is owned equally by Sven

Q68: Jamie transferred 100 percent of her stock

Q79: Clampett, Inc. has been an S corporation

Q85: Comet Company is owned equally by Pat

Q94: Which of the following statements is true

Q103: Grace transferred $800,000 into trust with the

Q115: Which of the following is a true