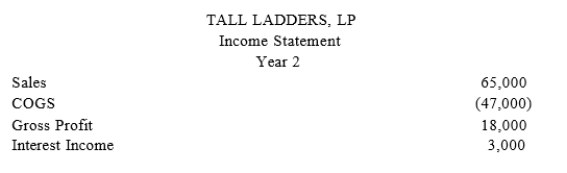

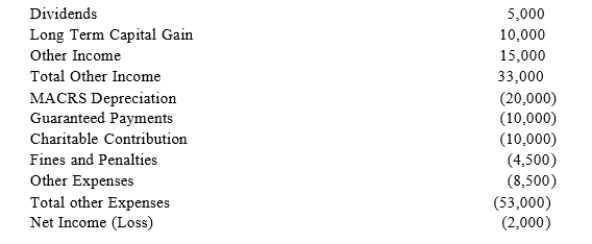

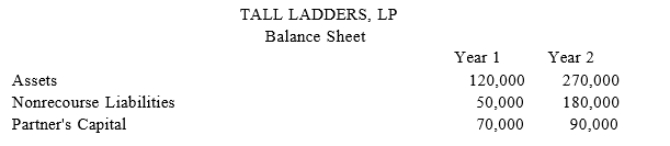

At the end of year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For year 2, Tall Ladders will pay Tony a $10,000guaranteed payment for extra services he provides to the partnership. Given the following IncomeStatement and Balance Sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of year 2?

Definitions:

Counselor

A professional trained to provide guidance and support in emotional, psychological, or social matters, often within a therapeutic context.

Disclose Sexual Abuse

The act of revealing experiences of sexual harm or exploitation, often in a safe and supportive environment.

Documented Reasons

Refer to recorded reasons or rationale, often used in contexts where explanations for decisions or actions are meticulously kept for documentation or evidence.

Overwhelming Guilt

An intense feeling of responsibility or remorse for a perceived or real wrongdoing, which can significantly impact mental health.

Q18: St. Clair Company reports positive current E&P

Q23: The tax return filing requirements for individual

Q31: If an S corporation shareholder sells her

Q33: The National Bellas Hess decision held that

Q34: Lamont is a 100% owner of JKL

Q51: Lansing Company is owned equally by Jennifer,

Q53: AIRE was initially formed as an S

Q63: In a given year, Adams Corporation has

Q63: Tar Heel Corporation had current and accumulated

Q134: An S corporation shareholder calculates his initial