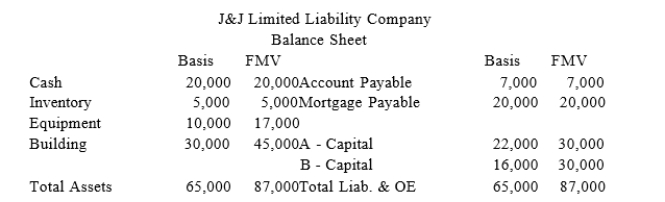

J&J, LLC was in its third year of operations when J&J decided to expand the number of members from two, A & B, with equal profits and capital interests to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a 1/3 capital interestin J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J when C receives her capitalinterest? If, instead, member C receives a 1/3 profit interest, what would be the tax consequences to membersA, B, and C, and to J&J?

Definitions:

Desynchronization

A state where natural biological rhythms, such as sleep patterns, become out of sync with environmental cues.

Alpha Waves

A type of brain wave detected by electroencephalography (EEG), associated with a state of relaxed alertness.

Eyes Closed

Refers to the state of having the eyelids shut, which can be voluntary or involuntary, affecting visual input and other sensory processing.

Beta Waves

A pattern of brain waves with a frequency of 13 to 30 Hz that are associated with active, alert, and focused states of consciousness.

Q3: In 2017, Moody Corporation recorded the following

Q47: Any losses that exceed the tax basis

Q47: The specific identification method is a method

Q47: All of the following are false regarding

Q56: Casey transfers property with a tax basis

Q79: In the sale of a partnership interest,

Q108: Like partnerships and C corporations, S corporations

Q120: An S corporation can make a voluntary

Q126: A corporation may carry a net capital

Q134: Which of the following statements regarding book-tax