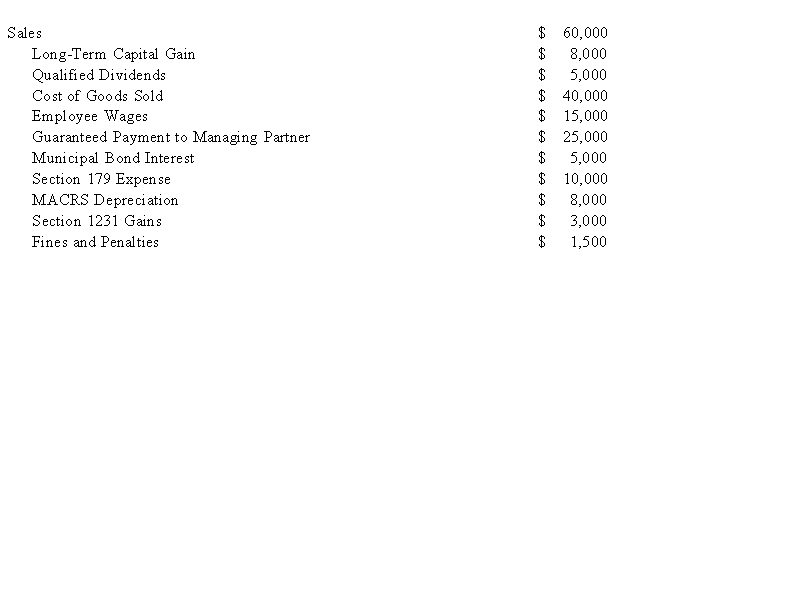

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:  Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Definitions:

Tax Rate

The degree of governmental claim on the earnings or profit of people and companies through taxation.

Operating Cash Flow (OCF)

A measure of the cash generated by a company's normal business operations, indicating its ability to cover operational expenses and invest in its business.

Tax Shield Approach

A method used in financial analysis to determine the value of tax deductions, such as interest on debt, which reduces taxable income.

Costs

Expenses incurred in the process of producing or acquiring goods and services, including materials, labor, and overhead.

Q2: ABC Corp. elected to be taxed as

Q6: Which of the following is not a

Q9: Hazelton Corporation, a U.S. corporation, manufactures golf

Q18: Lafayette, Inc. completed its first year of

Q26: Green Corporation has negative current earnings and

Q32: Which of the following tax rules applies

Q38: Spartan Corporation, a U.S. company, manufactures widgets

Q74: Don and Marie formed Paper Lilies Corporation

Q116: Regarding debt, S corporation shareholders are deemed

Q128: After terminating or voluntarily revoking S corporation