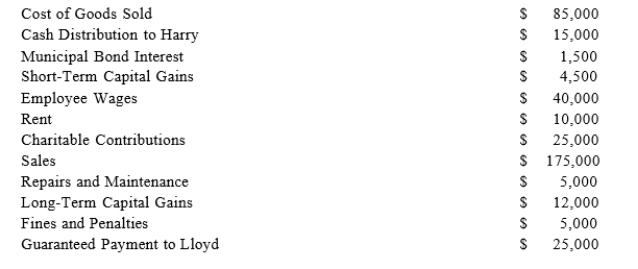

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the followin revenue, expenses, gains, losses, and distributions:  Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year?

Definitions:

Interneurons

Neurons that transmit impulses between other neurons, especially as part of a reflex arc in the central nervous system.

Sensory Neurons

Nerve cells that are responsible for converting external stimuli from the organism's environment into internal electrical impulses.

Motor Neurons

Nerve cells that initiate and conduct signals to muscles and glands, enabling movement and action.

Stem Cells

Undifferentiated biological cells capable of dividing to produce more stem cells or differentiate into various types of cells with specialized functions.

Q9: A distribution in partial liquidation of a

Q24: Separately stated items are tax items that

Q34: Absent a treaty provision, what is the

Q36: Viking Corporation is owned equally by Sven

Q56: Discuss the steps necessary to determine whether

Q65: Which of the following income items from

Q74: Which of the following is not calculated

Q82: Jason is a 25% partner in the

Q84: Randolph is a 30% partner in the

Q85: Comet Company is owned equally by Pat