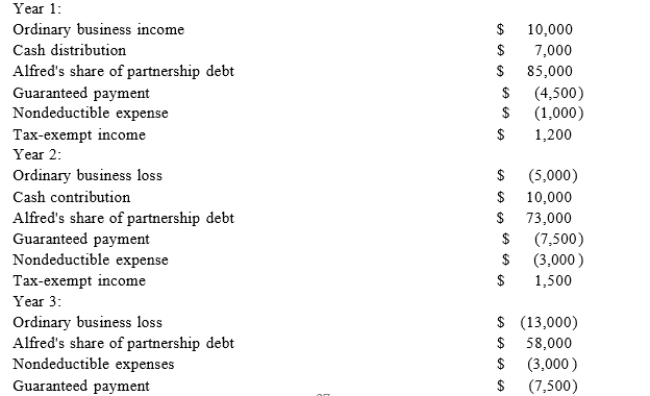

Alfred, a one-third profits and capital partner in Pizzeria Partnership needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for year 3 of the partnership, but Alfredonly knows that his tax basis at the beginning of year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for years 1 and 2.Using the following information from Alfred's year 1, year 2, and year 3 Schedule K-1, calculate his tax basis the end of year 2 and year 3.

Definitions:

Gender Identity

An individual's personal sense of their own gender, which may or may not correspond with the sex assigned at birth.

Reproductive Urges

The natural instinct or desire to reproduce and have offspring.

Gender Fluid

A person whose gender identity is not fixed and can change over time or depending on the situation.

Androgyny

The coexistence of both masculine and feminine personality traits in a single person.

Q12: Under proposed regulations issued by the Treasury

Q15: On April 18, 20X8, Robert sold his

Q20: The "30-day" letter gives the taxpayer the

Q52: Carey was researching a tax issue and

Q59: Tax elections are rarely made at the

Q67: Proposed and Temporary Regulations have the same

Q80: A partner's debt relief from the sale

Q80: Billie transferred her 20 percent interest to

Q82: ASC 740 is the sole source of

Q87: Lansing Company is owned equally by Jennifer,