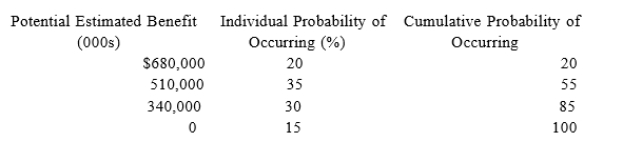

Morgan Corporation determined that $2,000,000 of its domestic production activities deduction on its current year tax return was uncertain, but that it was more likely than not to be sustained on audit. Management made the following assessment of the company's potential tax benefit from the deduction and its probability ofoccurring.  Under ASC 740, what amount of the tax benefit related to the domestic production activities deduction canMorgan recognize in calculating its income tax provision in the current year?

Under ASC 740, what amount of the tax benefit related to the domestic production activities deduction canMorgan recognize in calculating its income tax provision in the current year?

Definitions:

Horizontal Contracts

Agreements or cooperations between businesses that operate at the same level in the supply chain, often for mutual benefit or to reduce competition.

Customers' Goals

The objectives or desired outcomes that customers aim to achieve through purchasing goods or services.

Substitute Products

Goods or services that can serve as replacements for each other, satisfying similar customer needs or desires.

Competition

The rivalry among businesses to attract customers and achieve higher sales, profits, and market share.

Q18: When allocating expenses of a vacation home

Q40: A C corporation reports its taxable income

Q46: Gain or loss is always recognized when

Q54: Marlin Corporation reported pretax book income of

Q60: Just like distributions from qualified retirement plans,

Q68: Jamie transferred 100 percent of her stock

Q85: The date on which stock options are

Q92: Inez transfers property with a tax basis

Q98: Evergreen Corporation distributes land with a fair

Q110: According to Statement on Standards for Tax