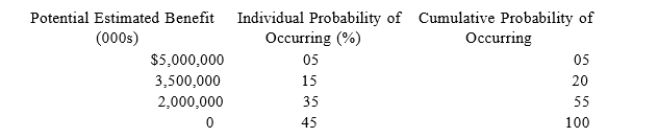

Acai Corporation determined that $5,000,000 of its R&D credit on its current year tax return was uncertain.Acai determined that there was a 40 percent chance of the credit being sustained on audit. Management made the following assessment of the company's potential tax benefit from the R&D credit and its probability ofoccurring.  Under ASC 740, what amount of the tax benefit related to the R&D credit can Acai recognize in calculating its income tax provision in the current year?

Under ASC 740, what amount of the tax benefit related to the R&D credit can Acai recognize in calculating its income tax provision in the current year?

Definitions:

Displaced Aggression

A psychological phenomenon where an individual directs their aggressive behavior towards a target other than the source of their frustration.

Affective Aggression

Aggressive behavior driven by negative emotions, such as anger or frustration.

Cognitive Neoassociationism

A theory suggesting that emotions are linked in the brain through their common cognitive processes, leading to affective responses from related thoughts or memories.

Personal Values

Core beliefs or standards that guide an individual's behavior and decision-making, reflecting what is important to them.

Q18: Roddy was researching an issue and found

Q45: Kathy is 60 years of age and

Q56: What is the maximum number of unrelated

Q62: Which of the following statements is not

Q65: For fraudulent tax returns, the statute of

Q82: Taxable fringe benefits include automobile allowances, gym

Q84: Tyson owns a condominium near Laguna Beach,

Q87: A taxpayer can avoid a substantial understatement

Q90: Leslie made a mathematical mistake in computing

Q112: For tax purposes, a corporation may deduct