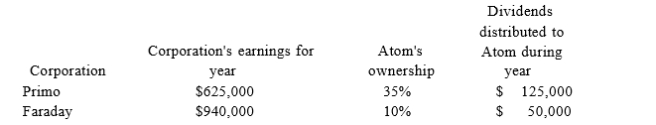

Atom Ventures Inc. (AV) owns stock in the Primo and Faraday corporations. The following summarizes information relating to AV's investment in Primo and Faraday as follows:  Assuming that AV follows the general rules for reporting its income from these investments, what is the amount of AV's book-tax difference associated with the investment in these corporations (disregarding the dividends received deduction)? Is it favorable or unfavorable? Is it permanent or temporary?

Assuming that AV follows the general rules for reporting its income from these investments, what is the amount of AV's book-tax difference associated with the investment in these corporations (disregarding the dividends received deduction)? Is it favorable or unfavorable? Is it permanent or temporary?

Definitions:

Poachers

Individuals who illegally hunt, catch, or harvest wildlife or plants from land where they do not have the rights to do so, often leading to conservation issues.

Black Market

An illegal trade of goods or services, operating outside of legal systems, often involving contraband.

Japanese Kudzu Vine

An invasive plant species known for its quick growth and ability to suffocate other plants by densely covering them.

Toxic Berries

Berries that contain poisonous substances which can pose health risks or be fatal to humans and animals if ingested.

Q3: Jenny (35 years old) is considering making

Q54: Tasha receives reimbursement from her employer for

Q56: Knollcrest Corporation has a cumulative book loss

Q64: Taxpayers with high AGI are not allowed

Q74: The longer a taxpayer plans on living

Q78: Which of the following statements best describes

Q88: Evergreen Corporation distributes land with a fair

Q91: IndusTree Inc. received $1,800,000 from the sale

Q93: Jasmine transferred 100 percent of her stock

Q110: According to Statement on Standards for Tax