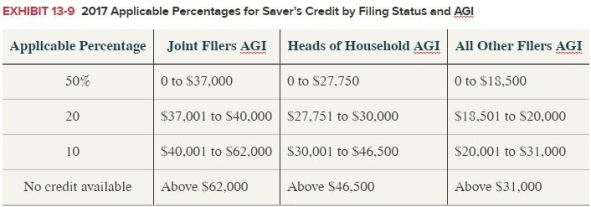

Aiko (single, age 29) earned $40,000 in 2017. He was able to contribute $1,800 ($150/month) to his employer sponsored 401(k). What is the total saver's credit that Aiko can claim for 2017? Exhibit13-9

Definitions:

Economic Analysis

The systematic approach to determining the optimal use of scarce resources, involving comparison of costs and benefits.

Consumers

Individuals or entities that purchase goods and services for personal use or consumption, driving demand in the economy.

Productive Resources

Inputs used in the production of goods and services, such as land, labor, and capital.

Q17: In general terms, the tax laws favor

Q21: Property expensed under the §179 immediate expensing

Q28: A flat tax is an example of

Q61: Qualified retirement plans include defined benefit plans

Q68: In the current year, Raven sold machinery

Q73: Which of the following is considered a

Q81: Sparrow Corporation reported pretax book income of

Q94: In the current year, FurnitureKing Corporation recognized

Q96: Which of the following statements regarding the

Q110: Participating in an employer-sponsored nonqualified deferred compensation