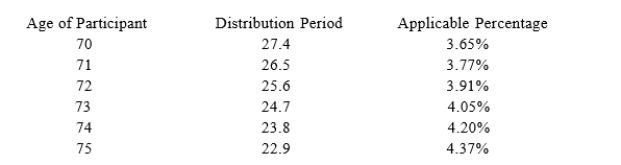

Sean (age 74 at end of 2017) retired five years ago. The balance in his 401(k) account on December31, 2016 was $1,700,000 and the balance in his account on December 31, 2017 was $1,750,000. In2017, Sean received a distribution of $50,000 from his 401(k) account. Assuming Sean's marginaltax rate is 25 percent, what amount of the $50,000 distribution will Sean have left after paying incometax on the distribution and paying any minimum distribution penalties (use the IRS table below in determining the minimum distribution penalty, if any).

Definitions:

Confirmation Bias

The tendency to search for, interpret, favor, and recall information in a way that confirms one's preexisting beliefs or hypotheses.

Conjunction Fallacy

A logical fallacy where people incorrectly judge the probability of the conjunction of two events to be more likely than the probability of either event alone.

Gambler's Fallacy

A cognitive bias where an individual erroneously believes that past events will affect the likelihood of future independent events, often seen in probability contexts.

Bilingualism

The ability to fluently speak two languages.

Q14: Suzanne, an individual, began business four years

Q25: Goodwill and customer lists are examples of

Q34: Assume that Bethany acquires a competitor's assets

Q47: Which of the following statements best describes

Q60: Just like distributions from qualified retirement plans,

Q70: For estimated tax purposes, a "large" corporation

Q83: Ashton owns a condominium near San Diego,

Q109: Participating preferred stock has a feature that

Q118: A corporation may be authorized to issue

Q125: Corporations have a larger standard deduction than