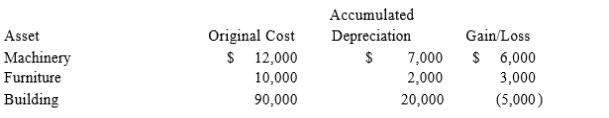

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:  Assuming Andrew's marginal ordinary income tax rate is 30 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Assuming Andrew's marginal ordinary income tax rate is 30 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Health Care Professional

Individuals qualified through education and training to provide health care services, such as doctors, nurses, and therapists.

Interview End

The completion or conclusion of an interview process.

Nurse's Statement

A formal account or record made by a nurse, detailing observations and care provided to patients.

Q9: In year 1, Kris purchased a new

Q22: What is the character of land used

Q43: For corporations, §291 recaptures 20 percent of

Q44: Qualified employee discounts allow employees to purchase

Q47: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2607/.jpg" alt=" A) $480. B)

Q80: Jonah, a single taxpayer, earns $150,000 in

Q89: An office desk is an example of:<br>A)

Q97: Which of the following is false?<br>A) The

Q165: Prior to June 30, a company has

Q176: A proxy is a document that gives