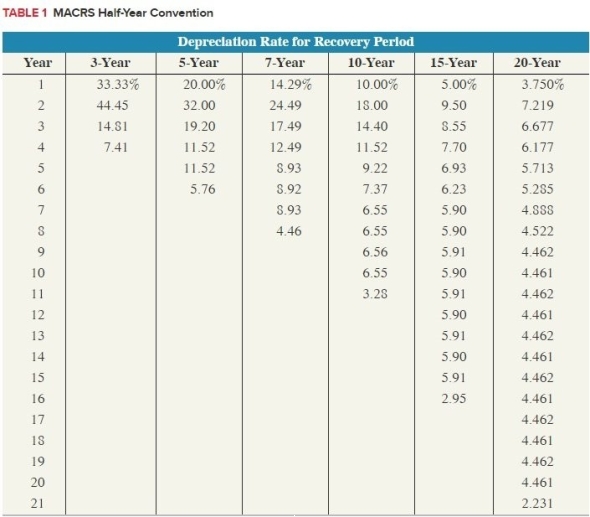

Amit purchased two assets during the current year. Amit placed in service computer equipment(5-year property) on April 16th with a basis of $5,000 and furniture (7-year property) on September9th with a basis of $20,000. Calculate the maximum depreciation expense (ignoring §179 and bonus depreciation). (Use MACRS Table 1)

Definitions:

σ Molecular Orbital

A symmetrical molecular orbital formed by the head-on overlap of atomic orbitals, where electron density is concentrated along the axis connecting nuclei.

Uracil

A nitrogen-containing base found in RNA which pairs with adenine during the formation of RNA strands.

Hybridization

The process or model by which atomic orbitals mix and form new hybrid orbitals of equivalent energies, explaining the bonding and shape in molecules.

Nitrogens

Chemical elements with the symbol N and atomic number 7, essential for all living organisms.

Q5: Geithner LLC patented a process it developed

Q11: In year 1, Gabby purchased a new

Q16: Careen owns a condominium near Newport Beach

Q19: A stock split is the distribution of

Q21: A section 83(b) election freezes the value

Q41: The estate tax is assessed based on

Q57: Which depreciation convention is the general rule

Q87: Taxes influence business decisions such as where

Q153: Dividend yield is computed by dividing earnings

Q174: A bond sells at a discount when