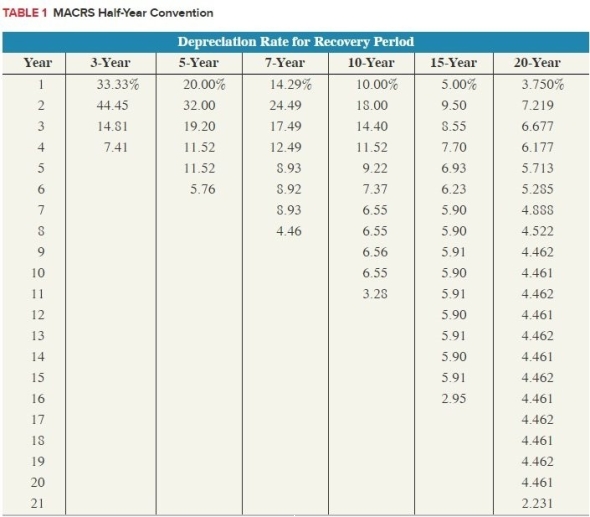

Reid acquired two assets in 2017: computer equipment (5-year property) acquired on August 6thwith a basis of $510,000 and machinery (7-year property) on November 9th with a basis of$510,000. Assume that Reid has sufficient income to avoid any limitations. Calculate the maximum depreciation expense including §179 expensing (but not bonus expensing). (Use MACRS Table 1)

Definitions:

Long-Run Profits

Profits that a firm anticipates it can maintain over a lengthy period by adapting its production and costs.

Economic Profits

The profit a company makes after deducting both its explicit and implicit costs, differing from accounting profits.

Marginal Costs

The price increase associated with the creation of an extra unit of a product or service.

Average Total Costs

The total costs of production (fixed and variable costs combined) divided by the quantity of output produced.

Q1: Which one of the following is not

Q5: Sin taxes are:<br>A) Taxes assessed to fund

Q20: Sarah sold 1,000 shares of stock to

Q31: Which of the following is not an

Q51: If a taxpayer places only one asset

Q58: The amount of annual cash dividends distributed

Q84: A debit balance in retained earnings is

Q101: When a taxpayer rents a residence for

Q102: Defined benefit plans specify the amount of

Q165: Prior to June 30, a company has