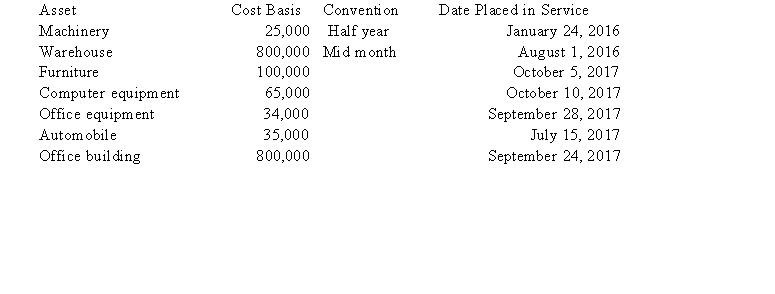

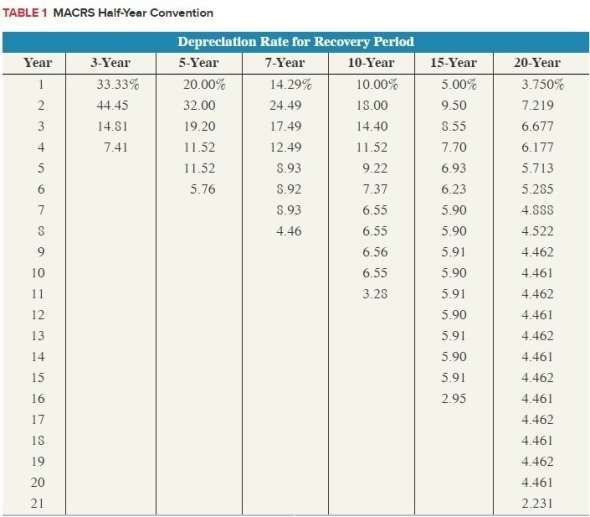

Boxer LLC has acquired various types of assets recently used 100% in its trade or business. Below is a list of assets acquired during 2016 and 2017:  Boxer did not elect §179 expense and elected out of bonus depreciation in 2016, but would like to elect §179 expense for 2017 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2017, (ignore bonus depreciation for 2017). If necessary, use the 2016 luxuryautomobile limitation amount for 2017. (Use MACRS Table 1 and Use MACRS Table 5 in the text)Exhibit 10-8 (Round final answer to the nearest whole number)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2016, but would like to elect §179 expense for 2017 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2017, (ignore bonus depreciation for 2017). If necessary, use the 2016 luxuryautomobile limitation amount for 2017. (Use MACRS Table 1 and Use MACRS Table 5 in the text)Exhibit 10-8 (Round final answer to the nearest whole number)

Definitions:

Holder

An individual or entity that possesses a negotiable instrument, such as a check or promissory note, and has the right to enforce it.

Bearer

Pertaining to negotiable instruments, it refers to the individual possessing the document entitled to the rights therein.

Instrument

A legal document formally evidencing a right or obligation, such as contracts, wills, or promissory notes.

Good Faith

A principle that emphasizes honesty, fairness, and integrity in the fulfillment of contractual obligations or in negotiations.

Q8: Kevin is the financial manager of Levingston

Q35: Distributions from defined benefit plans are taxed

Q50: All expected future payments are liabilities.

Q53: On March 30, Rodger (age 56) was

Q63: The gain or loss realized on the

Q81: The use of debt financing ensures an

Q93: The tax base for the federal income

Q100: The §1231 look-back rule recharacterizes §1231 gains

Q114: A stock _ keeps stockholder records and

Q155: Minimum legal capital requirements are intended to