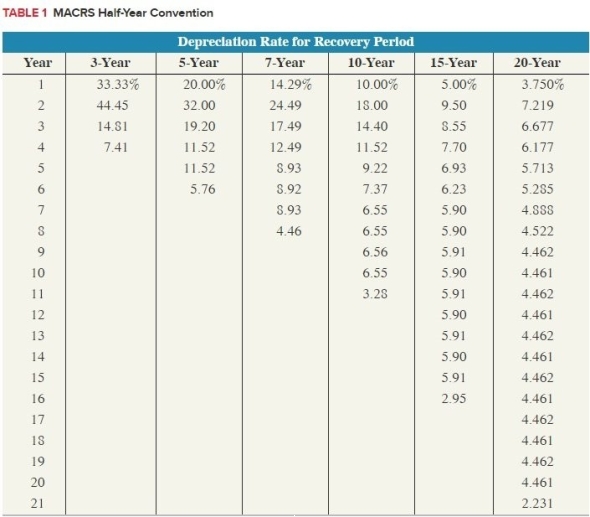

Eddie purchased only one asset during the current year. Eddie placed in service furniture (7-year property) on May 1st with a basis of $26,500. Calculate the maximum depreciation expense, rounded to the nearest whole number (ignoring §179 and bonus depreciation). (Use MACRS Table 1)

Definitions:

Market Price

The selling price of goods or services in the open market at which buyers and sellers agree.

New Equity Issue

The process of offering new shares by a company to the public or existing shareholders to raise capital.

Issue Costs

Expenses associated with the issuing of new securities, including underwriting, legal, and registration fees.

Seasoned Issues

Securities that have been publicly traded for a period of time, demonstrating stability and performance history to investors.

Q5: An installment note is an obligation of

Q59: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2607/.jpg" alt=" A) $3,573. B)

Q65: The mid-month convention applies to real property

Q70: What is a corporation? Identify the key

Q74: Individual 401(k) plans generally have higher contribution

Q85: Residential real property is not like-kind with

Q92: The main limitation in using book value

Q98: Jed Clampett is expanding his family-run beer

Q107: Which of the following statements regarding vesting

Q145: A corporation issued 5,000 shares of its