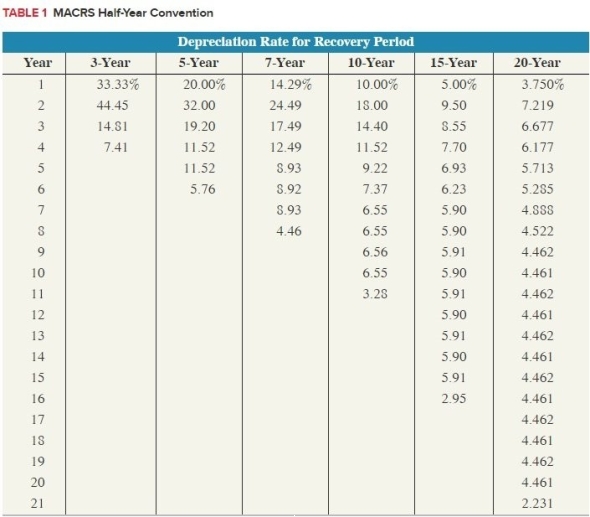

Amit purchased two assets during the current year. Amit placed in service computer equipment(5-year property) on April 16th with a basis of $5,000 and furniture (7-year property) on September9th with a basis of $20,000. Calculate the maximum depreciation expense (ignoring §179 and bonus depreciation). (Use MACRS Table 1)

Definitions:

Million Years Old

A term used to describe the age of geological formations, fossils, or the time since evolutionary events, measured in millions of years.

Thousand Years Old

Describes an object, organism, or structure that has existed for approximately one millennium.

Strategic Alliances

Formal agreements between two or more parties to pursue a set of agreed-upon objectives while remaining independent organizations.

Organisational Collusion

A situation where individuals within an organization conspire to act in a way that is against the rules or best interests of the organization.

Q4: The debt-to-equity ratio:<br>A)Is calculated by dividing book

Q8: Preferred stock with a feature allowing preferred

Q19: Taxpayers with home offices who use the

Q35: Distributions from defined benefit plans are taxed

Q56: Aharon exercises 10 stock options awarded several

Q92: Promissory notes that require the issuer to

Q98: Rick recently received 500 shares of restricted

Q111: A corporation issued 2,500 shares of its

Q130: Zhang Company has a loan agreement that

Q148: A corporation borrowed $125,000 cash by signing