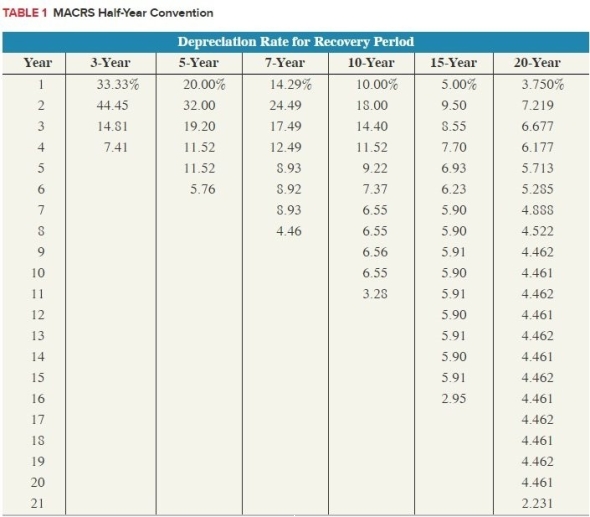

Reid acquired two assets in 2017: computer equipment (5-year property) acquired on August 6thwith a basis of $510,000 and machinery (7-year property) on November 9th with a basis of$510,000. Assume that Reid has sufficient income to avoid any limitations. Calculate the maximum depreciation expense including §179 expensing (but not bonus expensing). (Use MACRS Table 1)

Definitions:

Check Clearing

The process by which banks exchange checks and other negotiable instruments drawn on each other and settle their mutual debts and credits.

Lockbox System

A service provided by banks to companies for the receipt of payment from customers, under which payments are directed to a special post office box rather than the company’s address.

Cash Collections

The process of gathering and managing incoming cash payments from customers or clients.

Collection Procedures

The methods and processes used by a company to pursue and collect payments owed by customers.

Q1: Cassandra, age 33, has made deductible contributions

Q16: Aiko (single, age 29) earned $40,000 in

Q34: Interest payments on bonds are determined by

Q52: A company reported $960,000 in net income

Q53: Stocks with a price-earnings ratio less than

Q54: A single liability cannot be divided between

Q55: A 1% charge imposed by a local

Q62: §1231 assets include all assets used in

Q128: Prior period adjustments are reported in the:<br>A)Multiple-step

Q167: A company has 2,000,000 common shares authorized,