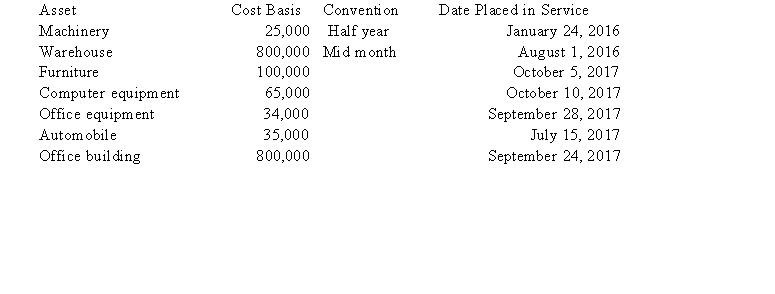

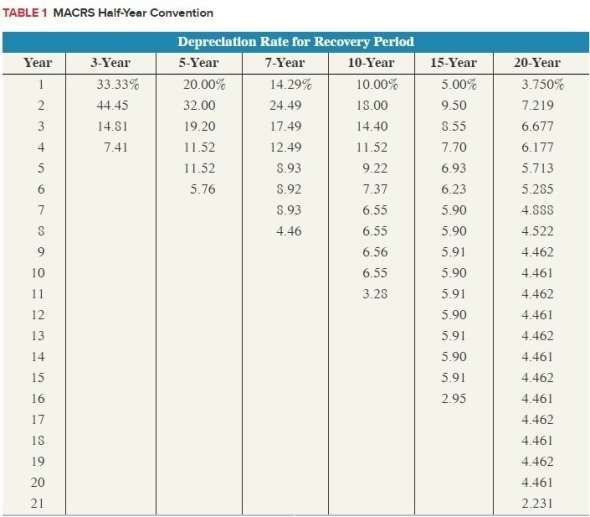

Boxer LLC has acquired various types of assets recently used 100% in its trade or business. Below is a list of assets acquired during 2016 and 2017:  Boxer did not elect §179 expense and elected out of bonus depreciation in 2016, but would like to elect §179 expense for 2017 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2017, (ignore bonus depreciation for 2017). If necessary, use the 2016 luxuryautomobile limitation amount for 2017. (Use MACRS Table 1 and Use MACRS Table 5 in the text)Exhibit 10-8 (Round final answer to the nearest whole number)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2016, but would like to elect §179 expense for 2017 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2017, (ignore bonus depreciation for 2017). If necessary, use the 2016 luxuryautomobile limitation amount for 2017. (Use MACRS Table 1 and Use MACRS Table 5 in the text)Exhibit 10-8 (Round final answer to the nearest whole number)

Definitions:

Gastrocnemius

The large muscle in the calf of the leg.

Muscles Contract

The process by which muscle fibers shorten and generate force, typically in response to a signal from the nervous system.

Muscle Tone

A state of muscle contraction in which a portion of the fibers are contracted while others are at rest.

Extensor Muscle

A muscle that extends or straightens a limb or part of the body, working in opposition to flexor muscles.

Q6: Which of the following is true regarding

Q23: A net §1231 gain becomes ordinary while

Q57: A bond is an issuer's written promise

Q59: Expenses of a vacation home allocated to

Q60: A liability is a probable future payment

Q70: Marc, a single taxpayer, earns $60,000 in

Q75: Which of the following statements regarding Roth

Q85: Which of the following statements regarding personal

Q88: Which of the following is true regarding

Q128: Bonds that mature at more than one