To be indifferent between investing in the two bonds, the Moe's, Inc. bond should provide Namratha t same after-tax rate of return as the city of Watkinsville bond (4.5%). To solve for the required pre-tax rate of return we can use the following formula: After-tax return = Pre-tax return × (1 - Marginal Tax Rate).

Moe's, Inc. needs to offer a 6% interest rate to generate a 4.5% after-tax return and make Namratha indifferent between investing in the two bonds.

4.5% = Pre-tax return × (1 - 25%); Pre-tax return = 4.5%/(1 - 25%) = 6%

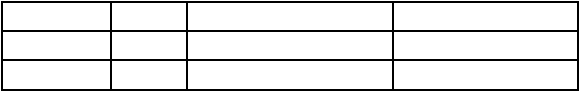

-Given the following tax structure, what is the minimum tax that would need to be assessed on Dora to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to beassessed on Dora to make the tax progressive with respect to effective tax rates?  Taxpayer Salary Muni-Bond Interest Total TaxDiego 30,000 10,000 1,500Dora 50,000 5,000 ???

Taxpayer Salary Muni-Bond Interest Total TaxDiego 30,000 10,000 1,500Dora 50,000 5,000 ???

Definitions:

Taliban

A fundamentalist political and military organization in Afghanistan known for its strict interpretation of Sharia law.

U.S. War

U.S. War typically refers to any military conflict involving the United States, ranging from declared wars with other nations to involvement in international conflicts and military operations.

Afghanistan

A landlocked country located in South Asia and Central Asia, known for its complex history of conflict and cultural heritage.

League Of Nations

An international organization founded in 1920 to promote peace and cooperation among countries, which was the precursor to the United Nations.

Q38: Racine started a new business in the

Q39: Payroll is an example of a contingent

Q49: Which of the following regarding the Form

Q51: Gross pay is:<br>A)Take-home pay.<br>B)Total compensation earned by

Q64: Which of the allowable methods allows the

Q71: Which of the following is false regarding

Q92: The main limitation in using book value

Q99: A company borrowed $40,000 cash from the

Q103: The carrying (book) value of a bond

Q127: The Discount on Bonds Payable account is:<br>A)A