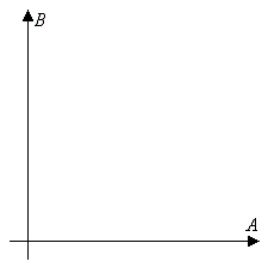

An investor has $150,000 to invest in two types of investments. Type A pays 5% annually and type B pays 6% annually. To have a well-balanced portfolio, the investor imposes the following conditions. At least one-third of the total portfolio is to be allocated to type A investments and at least one-third of the portfolio is to be allocated to type B investments. What is the optimal amount that should be invested in each investment?

Definitions:

Ordinary Income

Income earned from providing services or the sale of goods, typically subject to standard tax rates, as opposed to income classified as capital gains.

Equipment Distribution

The process of supplying equipment to various departments or locations within an organization or among individuals.

Cash Distributions

Payments made in cash by a corporation to its shareholders, typically from earnings or profits.

Tax-exempt Income

Income that is not subject to federal income tax, such as certain interest income from municipal bonds.

Q14: Evaluate the function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4588/.jpg" alt="Evaluate the

Q23: Solve the following quadratic equation by completing

Q25: Perform the sequence of row operations on

Q27: Use the sum-to-product formulas to write the

Q29: A 725-pound trailer is sitting on an

Q33: Of the products AB, BA, A<sup>2</sup>, and

Q33: Let Q represent a mass of radioactive

Q42: Find the standard form of the equation

Q46: When a perfectly competitive firm is at

Q79: Determine the domain of the function <img