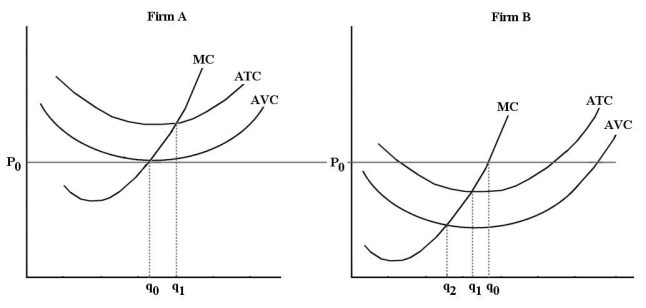

Consider the following cost curves for two perfectly competitive firms, A and B.  FIGURE 9-4

FIGURE 9-4

-Refer to Figure 9-4. If Firm B is producing at output level Q₂, and selling its output at p0, then FirmB should

Definitions:

Expense Ratio

The annual fee that mutual funds, index funds, and ETFs charge their shareholders, expressed as a percentage of the fund's average net assets.

NAV

NAV, or Net Asset Value, is the per-share value of a mutual fund or an exchange-traded fund (ETF), calculated by dividing the total value of all the securities in the portfolio, minus any liabilities, by the number of shares outstanding.

Mutual Fund

A financial instrument that pools money from various investors to invest in different types of securities, including stocks, bonds, money market instruments, and additional assets.

New York Time

The time zone observed in New York, typically Eastern Standard Time (EST) or Eastern Daylight Time (EDT), depending on the time of year.

Q18: The real purchasing power of an individual

Q22: Gretel's Computer Repair Store purchases a network

Q26: The theory of the firm is based

Q26: Suppose that capital costs $6 per unit

Q28: Suppose a firm's fixed costs are $100

Q29: A 725-pound trailer is sitting on an

Q39: Find all real zeros of the polynomial

Q39: If increasing quantities of a variable factor

Q39: The population P of a bacteria culture

Q51: If per capita income increases by 10