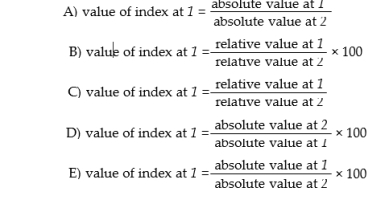

Let 1 stand for "any given period" and 2 stand for "base period". The formula of any index number can be written as:

Definitions:

Security Market Line

A representation in the Capital Asset Pricing Model (CAPM) that displays the relationship between the expected return of an investment and its risk.

Expected Return

The anticipated profit or loss from an investment over a given period, based on historical averages or statistical analyses.

Risk-Free Rate

The return on an investment with zero risk, typically represented by government securities.

Expected Return

Expected Return is the average return an investment is projected to generate, based on historical data or probabilistic modeling.

Q1: A fall in the price of raw

Q1: Suppose your municipality charges your household a

Q8: If the income elasticity of demand for

Q15: If money income is reduced by half,

Q19: With a downward-sloping straight-line demand curve, price

Q30: Canada has a much lower population density

Q53: Refer to Table 4-5. The cross-price elasticity

Q78: Refer to Figure 10-3. The firm's marginal

Q87: A major aim of Canadian competition policy

Q135: Recall that the Fixed Asset Turnover Ratio