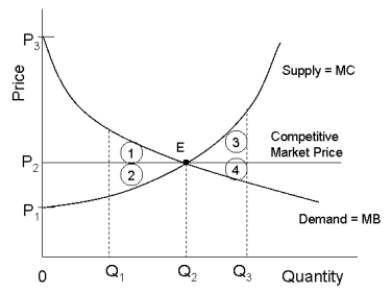

The diagram below shows the demand and supply curves in a perfectly competitive market.  FIGURE 12-5

FIGURE 12-5

-Refer to Figure 12-5. If output in this market were Q₁, the total loss in economic surplus relative to the competitive equilibrium would be illustrated by area

Definitions:

Security Market Line

A line that represents the relationship between the expected return of a security and its systemic risk, illustrating the risk-return tradeoff in the capital asset pricing model.

Expected Return

The average of all possible returns for an investment, weighted by the probability of each outcome, indicating the potential return over time.

Capital Asset Pricing Model

A theory detailing how systematic risk correlates with the expected return for investments, mainly in the stock market.

Stock Correlation

A statistical measure that describes how the movements of two stocks are related to each other.

Q3: the marginal cost to the seller of

Q10: Allocative efficiency concerns<br>A) the allocation of resources

Q14: In Canada, the Competition Act specifies that

Q15: Refer to Figure 10-4. In order to

Q16: Consider the following two statements. (1) An

Q20: In practice, legislated rent controls are usually

Q29: Tacit collusion in an oligopolistic industry<br>A) occurs

Q35: If a perfectly competitive industry was suddenly

Q39: Refer to Figure 5-4. Suppose the government

Q77: Many economies in central and Eastern Europe,