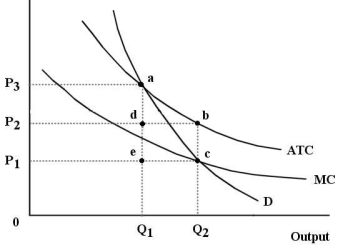

The diagram below shows the market demand curve and the cost curves for a single firm.  FIGURE 12-6

FIGURE 12-6

-Refer to Figure 12-6. Suppose this firm is a government-owned natural monopoly and imposes a price so as to achieve allocative efficiency in this market. The amount of tax revenue that the government must raise elsewhere in the economy to offset the losses of this firm is represented by the area

Definitions:

Subjective Assessment

An evaluation based on personal judgment rather than quantifiable evidence, often used in scenarios where objective measures are difficult to apply.

Deferred Tax Assets

Future tax benefits obtained due to temporary differences between the book value and tax basis of assets.

Deferred Tax Liabilities

Obligations for taxes owed in the future due to temporary differences between the tax basis of an asset or liability and its reported amount in the financial statements.

Book Income Tax Expense

The amount of income tax a company reports in its financial statements, which may differ from the tax owed to tax authorities.

Q22: The Canadian economy is achieving allocative efficiency

Q28: For a single-price monopolist, marginal revenue falls

Q34: Consider an example of the prisoner's dilemma

Q44: The right to exclude others from making

Q48: The statement that a country's rate of

Q70: Refer to Table 2-1. The increase in

Q78: To say that the demand curve for

Q79: The demand curve facing a monopolistically competitive

Q85: According to economist George Stigler, the process

Q108: What is the adjusted balance in the