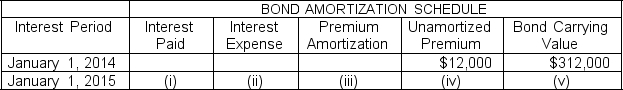

Presented here is a partial amortization schedule for Roseland Company who sold $300,000, five year 10% bonds on January 1, 2014 for $312,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (ii) ?

Which of the following amounts should be shown in cell (ii) ?

Definitions:

Bonds

Debt securities issued by entities such as corporations or governments to raise funds, which obligate the issuer to pay back the principal amount with interest by a specified date.

Cash Received

The amount of money that a business or individual has obtained from various sources, including transactions, investments, or financing.

Issued

Pertains to shares of a corporation that have been allocated to and are held by shareholders.

Straight-Line Amortization

Straight-line amortization is a method of gradually reducing the book value of an intangible asset over a fixed period of its useful life.

Q1: Carey Company buys land for $50,000 on

Q5: Trendy Company issued $600,000 of 8%, 5-year

Q20: A corporation purchases 40,000 shares of its

Q27: Admire County Bank agrees to lend

Q37: S. Lamar performed legal services for

Q66: An aging of a company's accounts receivable

Q127: The method most commonly used to compute

Q130: If a plant asset is retired before

Q237: Bond interest paid by a corporation is

Q240: The contractual interest rate is always stated